When your employees are traveling for business, they rack up expenses for transportation, lodging, food, and other incidentals. To manage your company’s spend on travel, it’s essential that these outlays are accurately documented, analyzed, and reimbursed. To do so, you need a clear and easy-to-follow expense reporting process.

In this guide, we explain what expense reporting is, why it’s important, and how to put a seamless spend management program in place for your organization.

What are expense reports?

An expense report is a detailed list of itemized expenses incurred by employees for business purposes. It is typically organized by expense type. It can include everything from office supply purchases to travel-related expenditures for items and services that your employees pay for with their own money or charge to a corporate credit card.

Expense reports can be paper or digital documents and are usually submitted with receipts and other documentation to back up each purchase.

The purpose of travel expense reports is multifold. They make sure employees are reimbursed for out-of-pocket expenses. Yet they also help your finance team manage and control business travel costs, and maintain accurate records for accounting and tax purposes. Expense reports validate that spending is compliant with your corporate policies and regulatory requirements.

How to create an expense report process: 7 best practices

An effective spend management program is rooted in three key components: an expense policy, an expense report form, and expense report software. When it’s managed well, expense reporting will help your organization seamlessly:

- Reimburse employees promptly and accurately for their out-of-pocket expenses.

- Track and analyze travel expenses to manage budgets and identify cost-saving opportunities.

- Verify that expenses comply with corporate policies and IRS regulatory requirements for business travel deductions.

- Provide accurate records for accounting and financial reporting.

Follow these best practices to develop an effective process:

1. Develop a clear expense policy

Your organization’s expense report rules should be clearly spelled out in your corporate travel policy so employees understand what’s expected of them. Collaborate with stakeholders from your finance, HR, and legal departments to create a comprehensive expense policy.

The policy should outline:

- Eligible expenses: The types of business expenses that are reimbursable (for example, airfare, accommodations, meals) and purchases that are not reimbursable, like souvenirs or other personal items, parking tickets, and personal entertainment.

- Employee spending limits: The maximum allowable amounts for different expense categories.

- Documentation requirements: The receipts and documentation needed for expense reimbursement.

- Submission deadlines: The timeframe in which expenses must be submitted after a business trip; for example, some companies require business travelers to file monthly expense reports.

Use straightforward language to explain the policy so it’s easy for employees to understand and review. And update the policy regularly to reflect changes in business needs and regulatory requirements.

2. Choose the right expense management software

An investment in expense management software automates and streamlines the expense reporting process, making it less time consuming for both employees and your finance office. As you’re evaluating your options, look for the following features:

- A user-friendly, intuitive interface: Be sure the software is easy to use and includes functionality like optical character recognition to easily scan, save, and categorize

- Customization: Look for software that can be customized to fit your company’s specific policies and

- Integration capabilities: Choose a solution that integrates seamlessly with your existing accounting software and systems so you can track expenses and spending in real time.

3. Train employees

Having a good policy and the right software isn’t enough. You have to train employees so they understand the policy and know how to use your expense reporting system. Training should include workshops and webinars that familiarize employees with the expense reporting process and give them access to detailed user guides and FAQs.

4. Streamline the submission process

Make expense reporting as easy as possible for employees by:

- Providing step-by-step instructions for submitting expenses, including a sample expense report.

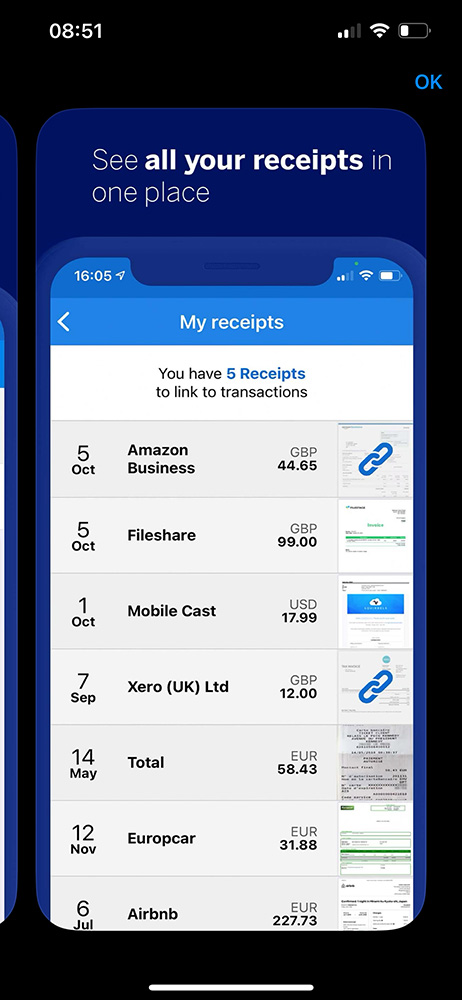

- Offering mobile apps that allow employees to capture receipts and submit reports on the go.

- Implementing automated workflows to streamline approval processes and reduce administrative burdens.

5. Enforce compliance

It’s critical that your expense process is compliant with your company policies and regulatory requirements. Automated policy checks that flag non-compliant employee expenses and regular audits can help make sure your process is consistent. You should also clearly communicate the consequences of non-compliance to prevent fraudulent or inappropriate claims.

6. Analyze and optimize

Analyzing expense data can provide valuable insights for optimizing your company’s overall travel spend. Strategies can include:

- Running regular reports to monitor spending patterns and identify trends.

- Comparing your company’s travel expenses against industry benchmarks to identify areas for cost savings.

- Gathering feedback from employees on the expense reporting process.

- Adjusting process based on employees’ input.

7. Foster a culture of accountability

You can create a culture of accountability by involving employees in the expense management process. To get started:

- Share insights and reports with employees and highlight the importance of accurate expense reporting.

- Recognize and reward employees who consistently follow policies and submit accurate reports.

- Involve employees in the refinement of your expense policies and processes.

What goes into an expense report?

To make sure that all business-related expenditures are accurately documented, your expense report template should collect all the information needed to process, validate, and approve each claim. The form should include room for the employee’s name, department, ID number, contact details, and dates of travel. Each expense entry should detail the date, type of expense, amount spent, and a brief description or justification of the business purpose. A summary section should calculate the total amount that should be reimbursed. Some companies require that expenses be coded to specific projects or clients.

Once an employee submits their expense report, it’s typically reviewed and approved by their manager or department head, then passed to accounts payable for payment.

Streamline your expense reporting process today. American Express Global Business Travel offers a panel of solutions adapted to your business needs, to help you streamline expense management.

Larger organizations need flexible, highly customizable solutions, like Amex GBT Neo™ (Neo) to configure advanced policies and workflows. Travel and Expense solutions such as Neo help organizations manage expense reports in an integrated way, for a full visibility over travel and expense costs. Contact our Neo team today to learn more.

Smaller businesses or non-for-profits often need an all-in-one solution with a quick and easy setup. Amex GBT Neo1™ (Neo1) helps small businesses manage employee spend management, including travel, budgets, virtual payment, purchasing goods, and expenses all in one place. Neo1 offers pre-configured policies and workflows to ease the configuration and help businesses get started with expense management in minutes. Neo1 is a free-to-subscribe* solution and it takes less than 5 minutes to register. Signup for Neo1 today.

*Complimentary access is provided to the Neo1 platform, which includes the ability to make online travel bookings. Some charges may apply for booking certain types of trips, predominantly low-cost air carriers and rail. Offline booking fees will apply for trips made via telephone. See Terms and Conditions when registering for Neo1 for full details of charges.

Share